Pinnacle Business Solutions – Income Tax Update – March 2025

- Published in Newsletters

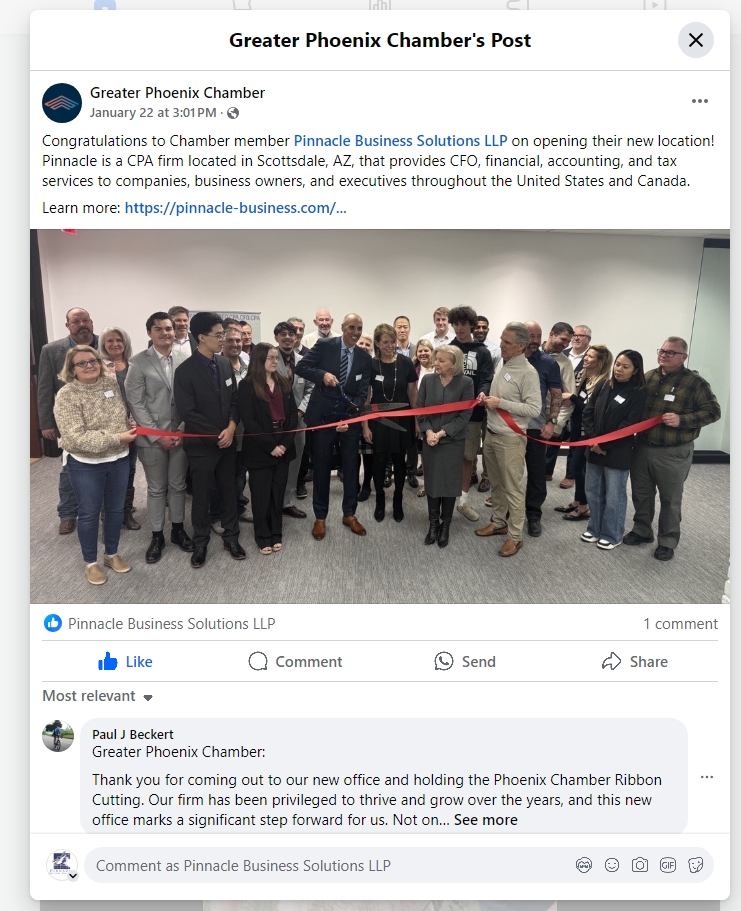

Pinnacle Business Solutions – Open House / Greater Phoenix Chamber Ribbon Cutting

Greater Phoenix Chamber:

Thank you for coming out to our new office and holding the Phoenix Chamber Ribbon Cutting. Our firm has been privileged to thrive and grow over the years, and this new office marks a significant step forward for us. Not only does it represent our ongoing commitment to excellence in finance, accounting and tax services, but it also positions us to better serve our clients and partners. We have been a member of the Greater Phoenix Chamber for over 22 years and value the services it provides to our business community.

https://www.facebook.com/100064283545197/posts/1011853500967425/

- Published in Newsletters

Put Your Kids on the Payroll: A Smart Tax Deduction Strategy for Business Owners

Running a business comes with many challenges, but it also opens the door to unique tax strategies. One often-overlooked opportunity is to “put your kids on the payroll.” Yes, hiring your children to work for your business can provide several tax benefits. Let’s break down how this strategy works and the key things you need to know to make it both effective and compliant with tax laws.

What Does It Mean to Put Your Kids on the Payroll?

Putting your kids on the payroll means employing them to perform legitimate work for your business and paying them a reasonable wage. By doing so, you can claim those payments as a business expense, reducing your overall taxable income. This strategy is particularly beneficial if your children are in a lower tax bracket because the wages they receive will be taxed at their rate instead of yours.

For example, if you’re in the 24% tax bracket and your child is in the 10% bracket, you shift some of your income to be taxed at a much lower rate, lowering your total family tax bill. But to take advantage of this strategy, you need to follow specific rules outlined in the Internal Revenue Code (IRC).

Benefits of Employing Your Children:

1. Deductible Wages as a Business Expense

When you hire your child and pay them a reasonable salary, the wages are considered a deductible business expense under the Internal Revenue Code. This means that any wages paid to your child reduce your business’s taxable income, lowering your overall tax liability. For example, if your business earns $100,000 in profits and you pay your child $10,000 in wages, your taxable business income is reduced to $90,000. This lowers your overall tax bill and keeps more money in your pocket.

2. No Social Security and Medicare Taxes

One of the most significant advantages of this strategy is that wages paid to a child under 18 are not subject to Social Security and Medicare taxes if the business owners are parents of the child. Avoiding these taxes means you save on the employer’s portion of payroll taxes, which amounts to 7.65% of wages. So, if you pay your child $10,000, you save $765 just on payroll taxes alone.

3. Exemption from Federal Unemployment Taxes (FUTA)

In addition to the Social Security and Medicare exemptions, wages paid to a child under 21 are also exempt from Federal Unemployment Taxes (FUTA). FUTA is generally 6% on the first $7,000 of wages. If your child’s wages qualify, this means you save up to $420 per child each year.

4. Shifting Income to Lower Tax Brackets

By paying your child a wage, you are essentially shifting a portion of your business income to someone who is likely in a much lower tax bracket. This strategy is beneficial because your child’s earned income is taxed at their rate, which could be as low as 10% or 0% if their total earnings are under the standard deduction amount ($15,000 for 2025). This could result in a significant family-wide tax saving. Additionally, because your child’s wages are earned income, they are not subject to the “kiddie tax” rules, which apply to unearned income.

5. Utilizing the Standard Deduction

The IRS allows everyone, including children, to claim a standard deduction. For 2025, the standard deduction is $15,000. This means your child can earn up to $15,000 and pay no federal income tax at all. If you pay your child, for example, $15,000 in wages, they will pay zero federal income tax, while you get to deduct the entire $15,000 as a business expense.

6. Funding Roth IRA Contributions

Your child’s earned income can be used to contribute to a Roth IRA. Because Roth IRA contributions can only be made with earned income, having your child on the payroll opens up this opportunity. Roth IRA contributions grow tax-free and can be withdrawn tax-free in retirement. This gives your child a head start on retirement savings, and over time, those contributions can grow substantially due to compounding.

7. Saving for College with Tax-Free Earnings

The money your child earns can be saved for future expenses, such as college tuition or a first car. If you opt to invest their wages in a custodial account, the growth on those earnings can be taxed at their lower rate. Alternatively, if your child’s earnings are contributed to a 529 college savings plan, the growth in that plan is entirely tax-free when used for qualified education expenses.

8. Teaching Financial Responsibility

Aside from the financial benefits, hiring your child can be a valuable life lesson. It teaches them the value of earning money, budgeting, and saving for the future. Your child can learn the basics of personal finance and develop a stronger work ethic by contributing to the family business. This experience could also serve as an opportunity to teach them about the importance of taxes, budgeting, and saving for future goals.

9. Business Growth and Family Involvement

Including your children in your business not only provides tax savings but also fosters a sense of ownership and responsibility. They get to learn the ins and outs of the business, making it more likely for them to continue the family legacy in the future. The hands-on experience your child gains could benefit the business directly, whether they’re helping with inventory management, handling social media, or assisting with customer service.

Key Considerations to Ensure Compliance

While putting your kids on the payroll can be a smart tax strategy, it’s essential to stay compliant with IRS rules. Here’s what you need to keep in mind:

1. The Work Must Be Legitimate and Appropriate for the Child’s Age

The work your child performs must be real work that is necessary for the business. This could include filing paperwork, organizing stock, helping with social media, or even cleaning the office. Make sure the job fits your child’s abilities and age. For example, it’s unreasonable to have a 7-year-old doing bookkeeping, but they can definitely help with simple organizing tasks.

2. Pay a Reasonable Wage

The wage you pay your child must be “reasonable” for the type of work performed. This means you can’t pay them $50 an hour for tasks that would typically be worth $10 an hour. The IRS may challenge the deduction if the wages are too high, so it’s essential to research standard pay rates for similar jobs.

3. Proper Documentation is a Must

You need to treat your child like any other employee. That means having a job description, maintaining timesheets, and issuing a W-2 form at the end of the year. Recordkeeping is crucial to proving that the work was real and the payments were legitimate. Documentation is your best defense against an IRS audit.

4. Taxes and Filing Considerations

Wages paid to your child are subject to income tax withholding, but the child may not owe much (or any) federal income tax if their total earnings are below the standard deduction amount ($15,000 for 2025). The child should still file a tax return to report the income, especially if there were any tax withholdings. This aligns with the “services of a child” rule, which states that compensation for services performed by a child is taxed at the child’s rate.

Potential Pitfalls and IRS Scrutiny

Although the benefits are clear, it’s crucial to avoid some common pitfalls. Paying your child an excessive wage, employing them in work they can’t reasonably perform, or not maintaining proper documentation could raise red flags with the IRS. If the IRS suspects that the payments are not for legitimate work or that the wages are too high, they could disallow the deduction, resulting in back taxes and penalties.

An example of this happening is when a business owner hired their children to do office work but paid them twice the going rate for similar positions. The IRS ruled that these payments were not reasonable and disallowed the deductions. The key takeaway? Pay your child fairly and keep detailed records.

How to Set Up Your Child on Payroll

If you’ve decided this strategy makes sense for your business, here’s how to get started:

1. Determine the Eligibility and Role

Make sure the work is appropriate for your child’s age and abilities. Write up a job description outlining their duties.

2. Process Payroll Correctly

Set your child up in your payroll system like any other employee. Make sure to complete all necessary tax forms, such as the W-4 for tax withholding and the I-9 for work eligibility.

3. Issue a W-2 and Keep Records

At the end of the year, issue your child a W-2 to report their wages. Keep all payroll records, timesheets, and job descriptions on file in case the IRS wants to review them.

4. Consider Additional Tax Benefits

Your child’s earnings could be used to fund a Roth IRA, providing them with a head start on retirement savings. Since contributions to a Roth IRA can’t exceed earned income, having your child on the payroll makes this possible.

Closing

Putting your kids on the payroll can be a fantastic way to save on taxes while instilling a strong work ethic and financial literacy in your children. To make this strategy work, always ensure the work is real, the wages are reasonable, and your recordkeeping is impeccable. Call us today to setup your Business Income Tax Planning meeting, we can be reached at (480) 980-3977!

- Published in Newsletters

A Comprehensive Guide to being Prepared for Tax Season: Individual and Business Income Tax Returns

Tax season can be a stressful time for many, but with the right preparation and guidance, it doesn’t have to be. Whether you’re an individual filer, a small business owner, or managing a more complex financial situation; understanding how to get ready for tax season is crucial. We will explore the different options for filing your tax return, including the pros and cons of using a Certified Public Accountant (“CPA”) and a Tax Preparer, so you can confidently choose who to trust with your financial information. Additionally, to ensure a smooth and efficient process, we have compiled a detailed checklist of the information and documents you’ll need to provide. By gathering these items, you will help your CPA/Tax Return Preparer provide an accurate and complete tax return for you. Remember, whether you are married, filing a joint return, or own business/real estate, this checklist will outline the most common required documentation to complete your tax return.

Who should file your tax return

There are many things to consider when deciding who will file your tax return. Do you choose a Certified Public Accounting Firm or a Tax Preparer? Does the firm or tax preparer prioritize data security? What characteristics should I look for in a CPA/Tax Preparer? Are they licensed? Do they offer IRS Representation, should you need it in the future? If you have asked any of these questions during tax season, we are here to help you answer them.

When deciding between a CPA firm and a tax preparer for your tax return, it’s essential to consider the unique advantages and disadvantages of each option.

CPA Firm

Pros:

- Expertise and Qualifications:

- CPAs have rigorous training and certification requirements. They possess a deep understanding of tax laws and accounting principles. In addition to a Certified Public Accounting License, a CPA/CPA firm will typically have a PTIN (Preparer Tax Identification Number), which can be obtained from the IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications.

- Comprehensive Services:

- CPA firms offer a broad range of services beyond tax preparation, including financial planning, accounting services, and business consulting. They can provide year-round advice on financial matters. CPA firms also typically offer mid-year tax planning meetings to their clients, allowing the discussion around new deductions and credits to happen earlier in the year so business owners can make decisions that can positively impact their upcoming tax liability.

- Representation:

- CPAs can represent you in dealings with the IRS, including audits and appeals.

- Credibility and Reliability:

- CPA firms typically have established reputations and a history of reliable service. All CPAs are required to have an undergraduate degree in accounting / tax from an accredited university. They are also required to pass the rigorous state CPA exam to obtain their CPA license/certification. They follow strict ethical guidelines and professional standards. CPA firms hold state certifications and are required to take over 40hrs of continuing education each year to stay up to date on the latest tax law changes. Any complaints or disciplinary actions against a CPA/CPA firm are public record and can be obtained from the Arizona State Board of Accountancy CPA Directory.

- Data Security Measures:

-

- CPA firms are bound by strict regulations and professional standards that govern data security and client confidentiality. CPA firms typically invest in firewalls, encryption, and secure servers. They often have dedicated IT staff responsible for maintaining and upgrading their security systems. Firms often have detailed policies and procedures to handle data breaches and cybersecurity threats, as well as the firm’s staff usually receives regular training on data security best practices. Many use advanced tax preparation software with built-in security features, and secure online portals for clients to upload their documents and access their tax returns. CPAs have a professional obligation to maintain client confidentiality and can face significant penalties for a breach, therefore this often results in a high level of vigilance when handling sensitive data.

Cons:

- Cost:

- Hiring a CPA firm can be more expensive than using a tax preparer, especially with a more complex tax return.

- Availability:

- During peak tax season, it may be harder to get an appointment with a CPA firm. CPA firms have clients that they work with on a regular basis, it is best to schedule your meetings with CPA firms in advance of any tax deadline.

Tax Preparer

Pros:

- Cost-Effective:

- Tax preparers usually charge lower fees than CPA firms, making them an attractive option for simple returns.

- Accessibility:

- Easy to find and schedule appointments, especially during tax season. Most paid tax preparers, especially when working at a local office or chain company, will have availability in the evenings and weekends allowing for more flexibility in scheduling.

- Efficiency:

- Experienced tax preparers can handle straightforward returns quickly, and typically are familiar with the common deductions and credits. Tax Preparers tend to only allow between 1-1½ hours for each tax return making the process very quick, however that can come with some disadvantages as well.

- Data Security:

-

- Large tax preparer chains often have corporate- level security policies and IT departments dedicated to data protection. These chains typically implement standardized security measures across all locations. Many use advanced tax preparation software with built-in security features, and secure online portals for clients to upload their documents and access their tax returns. Large chains typically have the capital to invest in high-tech security technology and resources and may conduct regular audits of their security practices.

Cons:

- Qualifications and Expertise:

- Tax preparers do not have the same level of training or certification as CPAs, many do not have undergraduate degrees in accounting / tax. Many have not taken the CPA exam to obtain their CPA license/certification. Tax preparers are not required to take continuing education on an annual basis to stay up to date on the latest tax law changes. Tax Preparers typically only have a limited amount of time to spend on your return before their next client meeting begins. As a result, you could potentially be missing tax credits or deductions that could have lowered your tax liability. If you need assistance in determining the type of credentials or qualifications that are held by a specific tax professional, use the IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications.

- Limited Services:

- Tax preparers typically focus solely on individual income tax returns and may not offer other services, such as tax planning, long-term financial planning or business consulting.

- Representation:

- Not all tax preparers can represent you in front of the IRS. If your return is audited, you may need additional assistance.

- Data Security Inconsistencies:

- The level of security can vary between different locations and individual preparers, depending on how well the corporate policies are enforced locally. High turnover rates can lead to gaps in training and awareness of security protocols. Tax Preparers may handle high volumes of clients, which can result in less personalized attention to data security. Tax Preparer firms typically have large databases of client information that can be particularly attractive to cybercriminals.

Detailed Checklist of Information and Documents

Gathering these items listed below will help your CPA or Tax Return Preparer provide a complete and accurate tax return for you.

Business Information

-

- Business information (name, legal type, accounting basis)

- Ownership Structure

- Operating agreement, articles of incorporation

- Financial statements (income statement, balance sheet, cash flows statement)

- Revenue details and copies of 1099-NEC received

- Business expenses (automobile, office supplies, phone, interest, equipment, legal, advertising, meals, travel, etc.)

- Payroll reports

- Research and development expenses

- Fixed asset list

- Asset purchases/sales

- Partner/ Shareholder Contributions / Distributions

- Business debt schedules

- Tax notices

- Prior year tax return

Personal Information

For new clients, we require the following personal details:

- Full Name of the taxpayer(s)

- Date of Birth

- Social Security Number(s)

- Address

- Contact Information (Phone number and email)

- Driver’s License

- Bank Information for direct deposit

- Prior Year Tax Return

Dependent Information (if applicable)

If you have dependents, please provide:

- Name of dependent(s)

- Date of Birth

- Social Security Number(s)

- Relationship to the taxpayer(s)

- Custody Information (full custody or split custody)

Income Information

Collect and provide the following income-related documents for all taxpayers on the return:

- Wages: W-2 forms

- Investment Income:

- Interest Income (1099-INT)

- Dividend Income (1099-DIV)

- Capital Gains (1099-B)

- Reports of any cryptocurrency transactions

- Rental Income:

- Address of rental property(s)

- Type of rental property (Residential or Commercial)

- Number of days the property was rented

- Rental Income and related expenses (property taxes, repairs, maintenance, insurance, etc.)

Retirement Income

Ensure you have documents related to:

- Pension Income

- IRA distributions

- Social Security Income

Other Income

Additional income sources may include:

- State tax refunds received

- Unemployment compensation (1099-G)

- Income from pass-through entities (K-1 from partnerships and S-corps)

- Dividend income from C-corporations

Adjustments to Income

Provide information on:

- Health insurance paid for self-employed individuals

- Student loan interest

- Educator expenses for teachers

Deductions

Gather documents related to:

- Medical expenses

- State or sales taxes paid

- Property taxes paid

- Mortgage interest

- Investment interest paid

- Donations (cash and non-cash, with receipts if over $500, and 1098-C for vehicle donations)

For applicable credits, provide:

- Invoices for solar panels

- Purchase agreements for electric vehicles

- Education expenses (1098-T)

- Foreign taxes paid (1099-DIV)

Estimated Tax Payments

If you have made estimated tax payments, please include:

- A list and dates of all payments made

- Copies of any notices received from tax authorities

Additional Information (if applicable)

Lastly, if applicable, provide your Personal Identity Theft Prevention Number from the IRS.

Conclusion

As tax season approaches, being well-prepared and making informed decisions about who will handle your tax return can significantly reduce stress and ensure accuracy. Taking the time to choose the right tax partner to prepare your tax return is critical! It will ensure your tax information and return is complete, accurate, and secure. It will also ensure your tax liability is minimized. Working with a partner that you can trust to look out for your best interests and represent you in dealings with the IRS, including audits and appeals is key.

By following the comprehensive checklist above, you will ensure a smooth and efficient tax filing process. We are here to make the tax preparation process as seamless as possible. If you have any questions or need assistance with collecting these documents, do not hesitate to reach out. Stay organized, keep track of your documents, and remember, we are here to help every step of the way!

If you have any questions or would like to schedule a tax planning or tax preparation meeting, do not hesitate to reach out to us at (480) 980-3977.

- Published in Newsletters

Boost Your Bottom Line: Why Mid-Year Business Income Tax Planning is a Must

Mid-year business income tax planning is an essential practice for businesses of all sizes. This process involves evaluating a company’s financial performance and tax situation partway through the fiscal year to make informed decisions and adjustments. Proactive tax planning can lead to significant financial benefits and ensure a smoother year-end tax filing process. Here are the top ten reasons why mid-year business income tax planning is crucial for any organization:

- Cash Flow Management:

- By evaluating your financial position mid-year, you can better predict your tax liability and set aside the necessary funds. This helps in avoiding cash flow shortages when taxes are due.

- Tax Savings Opportunities:

- Mid-year tax planning allows businesses to identify and implement tax-saving strategies before the year ends. This includes taking advantage of deductions, credits, and other tax benefits that may not be available if identified too late.

- Avoiding Penalties and Interest:

- Timely tax planning helps ensure that estimated tax payments are accurate and on time. This reduces the risk of underpayment penalties and interest charges from the IRS.

- Strategic Business Decisions:

- Reviewing your financials mid-year can provide insights into your business’s performance. This information is crucial for making informed decisions about investments, hiring, and other strategic moves that can impact your tax situation.

- Compliance and Documentation:

- Mid-year planning ensures that your business is on track with record-keeping and compliance requirements. This can simplify the year-end tax filing process and reduce the risk of audits and other compliance and legal issues.

- Adapt to Changing Tax Laws:

- Tax laws frequently change, and mid-year tax planning allows businesses to stay updated and adapt to new regulations, ensuring compliance and optimizing tax positions.

- Maximize Retirement Contributions:

- Planning ahead allows business owners and employees to make the most of retirement plan contributions, which can provide significant tax advantages and help secure long-term financial stability.

- Plan for Capital Expenditures:

- Mid-year planning helps businesses strategize their capital investments, ensuring they take advantage of available deductions and credits, and plan for depreciation expenses.

- Prepare for Growth and Expansion:

- Reviewing financials mid-year can highlight opportunities for growth and expansion. Proper tax planning can ensure that these initiatives are financially viable and tax-efficient.

- Improved Financial Forecasting:

- Mid-year tax planning provides a clearer picture of the company’s financial health, enabling more accurate financial forecasting and budgeting for the remainder of the year.

Together, these reasons underscore the importance of regular, proactive tax planning as a critical component of effective business management.

Mid-year business income tax planning is not just a financial exercise but a strategic imperative for businesses aiming to thrive in a competitive landscape. By addressing tax liabilities and opportunities proactively, companies can ensure optimal financial health, minimize risks, and position themselves for growth. From managing cash flow and avoiding penalties to capitalizing on tax savings and staying compliant with evolving tax laws, the benefits of mid-year tax planning are substantial. Incorporating this practice into your business routine will not only simplify year-end processes but also empower you with the insights and flexibility needed to make strategic decisions confidently. Ultimately, effective tax planning paves the way for sustained business success and long-term financial stability.

Call us today to setup your Mid-Year Business Income Tax Planning meeting, we can be reached at (480) 980-3977!

- Published in Newsletters

Prepare Business Financial Plans – Eliminate Surprises and Sleep at Night

Many business owners work tirelessly to develop excellent product and service offerings and/or high-quality manufacturing and distribution capabilities. However, when it comes to putting that same energy and focus into a financial plan for their business, they come up short. However, it is the financial plan that helps them manage their growth and ensure they are getting the right return on their investment of time and resources. The financial plan also enables a business owner more effectively communicate its long-term plan with its banks, investors and co-travelers.

Business Goals and Objectives

The first step in this planning process is to identify objectives and goals associated with the new or expanding business. By establishing performance goals, the entrepreneur sets achievement levels to work toward, as well as a method of measurement to evaluate actual performance relative to these goals. A business owner can now track its performance monthly/weekly compared to these goals and identify where it is on-track and off-track. Those areas where it is on-track continue to execute the plan, those areas where it is off-track make slight changes to get back on-track as soon as possible. Without goals, it is impossible to know if actual performance is good enough to meet the company’s financial obligations: payroll, accounts payable, loan payments, return to shareholders.

A wise business owner once said, “If you do not choose a destination, any path you take will get you there!” You can be sure that your bank or investors have specific expectations. Failure to meet these minimum levels of production may result in your financiers asking you to take your business elsewhere. Not a pleasant thought, yet it happens regularly when management does not pay attention to the numbers.

Components of Financial Plan

A good financial plan begins with a good understanding of the business. How has the business performed in the past, and what is it expected to do in the future? What operational plans does the management team have to be successful in the future? What are the business goals for the next year, and what are the resulting action items the company plans to execute in order to achieve these goals? These goals and action items can include items such as: new product or service offerings, increased sales in a particular market, increased marketing efforts, increased manufacturing capability or operational efficiency.

Once the organization has defined its operational plans for the future, the next step is to translate these operational plans into the financial plans. The financial plan should consist of a set of monthly or quarterly financial statements including an income statement, balance sheet and cash flow statement. These financial statements help you to understand how your company will perform in the future, for example does your business generate enough cash flow to cover its payroll, insurance, advertising expense or debt service. If not, the company has the opportunity to revise its plans to achieve its goals. These financial statements along with other financial metrics and goals can then be used as benchmarks to measure the company’s actual performance throughout the year. You can also use this financial plan to evaluate other business opportunities that you may encounter throughout the year. For example, you may use your plan to help you evaluate whether or not you should acquire a competitor in your industry or divest of a particular segment of your business.

Financial goals could include the following:

- Total sales/revenue – ideally, it should reflect a reasonable increase each year

- Gross margin – stable with industry or improving each year

- Expenses – as low as possible, increasing only as needed

- Capital expenditures – as low as possible, increasing only as needed

- Profitability – stable with industry or improving each year

- Cash flow – ideally, it should reflect a reasonable increase each year

- Return on investment – ideally, this should be better than your industry average

These are just a few ideas that may or may not be appropriate to your particular business. The point is that management should continually set realistic performance goals and monitor the results. The bottom line: do you know where your company is going, and are you leading or following?

Time-Frames in Financial Plans

Financial plans can cover a variety of time-frames; some look out 10 years into the future, while others look out 2 quarters into the future. Most companies do a combination of long term financial planning, which looks at the next three to five years, in combination with more detailed short term financial planning that looks at the next 6 to 12 months.

Most companies begin preparation of their financial plans for the following year and beyond in the third and fourth quarter of the current year. The larger the company the longer the process can take and the earlier in the year these companies begin. The key is to give yourself adequate time to do your research and get your financial plan in place before beginning the new year.

Based on our experience working with clients over the past 21 years, here are some of the items we have noted with clients that utilize financial plans and those that do not. Which category do you want to be in?

Case Study #1 – No Financial Plan

- Client does not see value in financial planning and does not prepare a good plan

- Client does not perform competitive financial analysis of business

- Client does not monitor key financial metrics – profit, liquidity, solvency ratios

- Client is not aware of bank loan covenants

- Market conditions change and client is faced with a business recession

- Lack of diversification in client base results in significant decline in revenue

- Client is caught by surprise when it begins incurring monthly net losses and negative cash flow

- Client defaults on bank loans covenants and bank calls loan forcing workout

- Client forced to lay-off staff

- Client losses its commercial building to its bank

- Client forced to sell business at fire sale prices

Case Study #2 – Detailed Financial Plan

- Client prepares a detailed 5 year financial plan and updates it on an annual basis

- Client measures its financial performance relative to its plan on a monthly basis

- Client identifies financial challenges while they are small and makes minor course corrections to stay on track and hit its goals

- Client completes competitive financial analysis on an annual basis to understand its performance relative to its industry averages

- Client improves revenue growth over 30% per year

- Client improves profitability over 25% per year

- Client able to make long term commitments to new employees

- Client shares financial plan and performance with its bank on a monthly basis

- Bank approves client for working line of credit, building loan and equipment loan

- Client maintains strong balance sheet to allow it to acquire competition in downturn

- Client maintains profitability and positive cash flow through recession

- Client able to perform mid year tax planning to lower tax liabilities

- Client sleeps peacefully at night knowing that it is on-track to meet its goals

Uses of a Financial Plan

Once you have completed your financial plan, you now have a road map you can use to guide your progress and actions throughout the year. It will help you to quickly identify where you may not be on-track with your plan, so that you can quickly course-correct to get your business back on-track. You can also use this financial plan to evaluate other business opportunities that you may encounter throughout the year. For example, you may use your plan to help you evaluate whether or not you should acquire a competitor in your industry or divest of a particular segment of your business. Your financial plan can also be shared with outside investors, employees, or business partners to educate them on your business and show them where your business is headed. You can also use your financial plan to identify your future financing needs and secure the financing you need.

Studies have shown time and time again that the more a business measures its performance against established goals, the more likely it is to improve its performance. A good financial plan is one of the key tools you can use to measure your company’s performance. A good financial plan can help your company exceed its goals, and can help ensure the company’s financial performance is good enough to meet its financial obligations. Don’t wait any longer, give us a call today, let us help you: prepare your business financial plan, eliminate surprises and sleep at night!

Please let us know if you have questions concerning financial plans or any related topics, we can be reached at (480) 980-3977!

- Published in Newsletters

Tax Saving Strategies for Business

As we approach tax season, it’s crucial for businesses to optimize their tax planning strategies to maximize savings and ensure compliance. Here are five key strategies to consider:

1) Take Advantage of Deductions:

One of the most effective ways to reduce taxable income is by leveraging deductions. This includes expenses such as salaries, rent, utilities, and business-related supplies. Keep meticulous records of all deductible expenses throughout the year to ensure you’re not missing out on potential savings. Strategically timing the recognition of income and expenses can also have a substantial impact on taxable income. Consider deferring income to the following year or accelerating deductible expenses into the current year to optimize tax savings.

2) Contribute to Retirement and Health Plans:

Contributing to retirement plans, such as a 401(k) or SEP IRA, not only helps secure your financial future but also provides immediate tax benefits. Contributions to these plans are typically tax-deductible, reducing your taxable income for the year. Offering health insurance benefits to employees not only helps attract and retain top talent but can also provide tax advantages for businesses. Employer contributions to employee health insurance premiums are typically tax-deductible as business expenses, reducing taxable income.

3) Utilize Tax Credits:

Tax credits are powerful tools for reducing tax liability as they directly offset the amount of tax owed. Research and take advantage of available tax credits for businesses, such as the Research and Development Tax Credit, Work Opportunity Tax Credit, and Small Employer Health Insurance Tax Credit. The Research and Development Tax Credit, in particular, incentivizes innovation by providing a credit for qualified research expenses, including wages, supplies, and contract research costs.

4) Maximize Section 179 Deduction and Bonus Depreciation:

Section 179 and Bonus Deprecations of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year. This deduction can provide significant tax savings by allowing businesses to immediately deduct the cost of eligible assets rather than depreciating them over time. Be sure to take advantage of this deduction before the annual limit is reached.

5) Employ Income Splitting Strategies:

For businesses with multiple owners or family members involved, consider income splitting strategies to distribute income among individuals in lower tax brackets. This can be achieved through salary adjustments, dividends, or utilizing family members in the business. Hiring your children to work for your business and paying them a reasonable salary for work they perform, can shift income from your higher tax bracket to their lower tax bracket. Additionally, their earnings may be exempt from certain payroll taxes, such as Social Security and Medicare taxes.

By implementing these tax-saving strategies, businesses can minimize their tax burden while maximizing cash flow for growth and development. Remember, proper tax planning is not only about reducing taxes but also about positioning your business for long-term success and financial stability. Please let us know if you have any questions regarding these strategies or any other tax compliance or planning issues, we can be reached at (480) 980-3977!

- Published in Newsletters

Is the Research and Development Tax Credit Right for your Business?

Is The Research and Development Tax Credit Right for Your Business?

With the start of the year, businesses continue thinking about potential tax saving strategies. With these discussions comes considering the possibility of any tax credits that could be useful for the business to participate in. This could range from Energy efficiencies, to increasing charitable contributions, to Research and Development. Today we will talk about the Research and Development Tax Credit; what is it, who qualifies for it, the benefits, any changes that have occurred in the last year surrounding the credit, and how is the research and development tax credit calculated.

Research And Development Tax Credit: What Is It?

The Research and Development Tax Credit allows businesses to take a dollar-for-dollar reduction in the company’s income tax liability based on the research and development activities of that company. The company can elect to apply a portion of the research credit as a payroll tax credit against the employer’s share of social security tax. For taxable years beginning after December 31, 2015 and before January 1, 2023, the maximum research credit that can be applied toward payroll taxes was $250,000. Eligible businesses to take a portion of the credit against payroll taxes must have under $5 million in gross receipts in the current year and no more than five years of generating gross receipts including the current year.

An activity qualifies as research and development if is aimed at discovering new knowledge that benefits the development of a new product or service, new process or technique, or the improvement of an existing product. Costs that can be identified with research and development activities are: Materials, equipment, and facilities; personnel; intangible assets; contract services; and indirect costs.

- Materials, equipment, and facilities that are acquired or constructed for the purpose of research and development activities but have a potential future alternative use would still be capitalized as a tangible asset. However, if the materials, equipment, and facilities were consumed or have no alternative future use then these would be considered research and development costs and expensed at the time incurred.

- For personnel, salaries or wages for the employees who actively participated in research and development activities are expensed as a research and development cost.

- Intangible assets that are purchased from third parties for the purpose of use in research and development and have an alternative future use are amortized over the useful life. The amortization of these intangibles that were used in the research and development activities are expensed. However, the intangibles that are purchased for use in research and development and have no alternative future use are expensed in the time incurred.

- Contract services in connection with the research and development and work performed by a third party on behalf of the company would all be included in research and development costs.

- Indirect costs should be reasonably allocated as a research and development cost. However, if there are any indirect costs where it is not clearly identified to be connected to the research and development then it should not be included in those costs.

Research And Development Tax Credit: Who Qualifies to Take the Credit?

Eligible businesses that qualify to take the research and development tax credit are small businesses structured as a partnership, sole proprietorship, or a corporation that has no publicly traded stock. The average annual gross receipts for the three proceeding tax years need to be less than $50 million to take advantage of this tax credit. In order to take advantage of the credit the research must be conducted inside the United States, Puerto Rico, or a U.S. possession. The business must engage in activities considered “qualified research”, which involves work that creates new products, processes, or technology advancements. Accurate record keeping of the research and development activities are required for taking advantage of the credit.

Research And Development Tax Credit: What Are the Benefits?

There are many benefits for a company to conduct research and development activities and taking advantage of this credit.

- Financial incentive: With a dollar-for-dollar reduction in tax liability, the research and development credit allow businesses the freedom to invest their money into improving their products and processes.

- Stimulates Innovation and creates competitive advantage: Research and development is meant for discovering new knowledge and developing innovations, creating new products, improving old products, improving processes, and technological advances. The credit helps companies to invest more money in research and development which ultimately allows for more of a competitive advantage over other companies that are not investing in improvements.

- Job Creation: Typically, when companies invest a lot of time and money into research and development, they have personnel specifically assigned to a part of the research and development process. This creates jobs in areas such as engineering, design, and development.

- Offset development costs: Research and development often requires the investment in a larger labor force, materials used in the development, and new equipment used in research and development. Research and development tax credits allow a company to reduce their tax liability, making these investments more financially feasible.

- Compliance with Federal Regulations: Businesses are required to document their research and development processes in order to take the tax credit which leads to increased regulation compliance. Businesses wishing to take this credit must ensure they fit the criteria for the credit and report with transparency.

Research And Development Tax Credit: What Changes Have Occurred in The Last Year?

In both 2022 and 2023, there have been two major changes to the Research and development tax credit. One regarding applying part of the credit to payroll tax liability, and the other regarding Section 174 capitalization requirements.

- Electing to apply part of the R&D tax credit to payroll tax:

As of 2023, the maximum amount of payroll tax research credit that a qualified small business can elect to apply against payroll tax liability increased to $500,000 for tax years beginning after December 31, 2022. Eligible businesses to take a portion of the credit against payroll taxes must have under $5 million in gross receipts in the current year and no more than five years of generating gross receipts including the current year. As of 2023, the increase to $500,000 will end at the conclusion of the 2023 taxable year, unless the provision is extended by congress.

- New Section 174 capitalization requirements:

Beginning tax years on or after January 1, 2022, R&D expenditures under section 174 can no longer be deducted. Businesses are now required to capitalize costs identified a research and development and amortized over a five-year period for any domestic research. The R&D expenditures do not currently need to be capitalized on the company’s balance sheet; however, the expenditures do need to be capitalized in terms of the business’s tax return.

Research And Development Tax Credit: How is the Credit Calculated?

The research and development tax credit can be calculated using one of two methods: the Traditional Method and the Alternative Simplified Credit Method.

- Traditional Method

The traditional method is typically used for businesses who have already claimed the research and development tax credit in the past. Under the traditional method, the credit is 20% of the company’s current year qualified research expenses that exceed a base amount. The base amount is the product of a fixed base percentage and the average annual gross receipts of the taxpayer for the four tax years preceding the tax year for which the credit is being determined. However, the base amount can never be less than 50% of the qualified research expenses for the credit year. Additionally, the base amount cannot exceed 16%.

A huge part of the traditional method is the company having historical qualified research expense data to determine the fixed-base percentage. The fixed-based percentage is computed as the aggregate qualified research expenses for tax years beginning after Dec. 31, 1983 and before Jan. 1, 1989 (base period), divided by the aggregate gross receipts for the same period. For companies defined as start-up companies, meaning any company whose first tax year with both gross receipts and qualified research expenses begins after Dec. 31, 1983, or any company that has fewer than three tax years between Dec. 31, 1983 and Jan. 1, 1989, the fixed base percentage is 3% for the first five years where qualified research expenses exist and then a moving average formula of gross receipts to qualifies research expenses. Below is an example of the traditional method calculation:

|

Traditional Method: 21% Corporate Tax Rate |

|

|

Current Year Qualified Research Expenses |

2,500,000 |

| Fixed Base Percentage |

16% |

| Average Annual Gross Receipts for Prior Four Tax Years |

10,000,000 |

| Base Amount (10,000,000*16%) |

1,600,000 |

| Excess of Qualified Research Expenses over Base Amount (2,500,000-1,600,000) |

900,000 |

| Smaller of Excess Qualified Research Expenses or 50% of Qualified Research Expenses (900,000 < (2,500,000*50%=1,250,000)) |

900,000 |

| Gross Credit (900,000*20%) |

180,000 |

| Reduced Credit Under Section 280C (180,000*21%=37,800, 180,000-37,800=142,200) |

142,200 |

For companies who have not claimed the research and development tax credit in the past or do not have the data necessary to determine their historical qualifies research expenses will most likely use the second method.

- Alternative Simplified Credit Method

The Alternative Simplified Credit Method is equal to 14% of the excess of qualified research expenses for the current tax year over 50% of the average qualified research expenses for the three preceding tax years, also known as the taxpayer’s “base period”. If the company had no qualified research expenses in any of the three preceding tax years, the Alternative Simplified Credit equals 6% of the qualified research expenses for the tax year for which the credit is being determined. Despite the difference in the tax credit rates, the Alternative Simplified Credit Method can be a less complicated methodology to compute the credit when historical data is an issue.

There is a four-step process involved in calculating the Alternative Simplified Credit:

- Figure out the company’s average qualified research expenses for the past 3 years

- Multiply that average by 50%

- Subtract the result of step 2 from the company’s current year qualified research expenses

- Calculate the credit by multiplying the result of step 3 by 14%

Below is an example of the Alternative Simplified Credit Method calculation:

|

Alternative Simplified Credit: 21% Corporate Tax Rate |

|

| Current Year Qualified Research Expenses |

2,500,000 |

| Sum of Prior 3 Years Qualified Research Expenses |

7,500,000 |

| Average of Prior Years Qualified Research Expenses (7,500,000/3=2,500,000 (Average)) (2,500,000*50%=1,250,000) |

1,250,000 |

| Excess Qualified Research Expenses (2,500,000-1,250,000=1,250,000) |

1,250,000 |

| Gross Credit (1,250,000*14%=175,000) |

175,000 |

| Reduced Credit Under Section 280C (175,000*21%=36,750, 175,000-36,750=138,250) |

138,250 |

If the company had no qualified research expenses in the three preceding tax years and use the 6% of the qualified research expenses for the credit:

|

Alternative Simplified Credit: No QRE in 3 preceding years, 21% Corporate Tax Rate |

|

| Current Year Qualified Research Expenses |

2,500,000 |

| Gross Credit (2,500,000*6%= 150,000) |

150,000 |

| Reduced Credit Under Section 280C (150,000*21%=31,500, 150,000-31,500=118,500) |

118,500 |

Whether you are currently taking part in research and development or you are considering if this would benefit your company, keep in mind the requirements for taking the credit, qualifications required to determine if the expenditures are research and development costs, how any updates to the credit can affect your business, and which credit calculation method would be best for your business. Please let us know if you have any questions regarding the research and development tax credit or any other tax compliance or planning issues, we can be reached at (480) 980-3977.

- Published in Newsletters

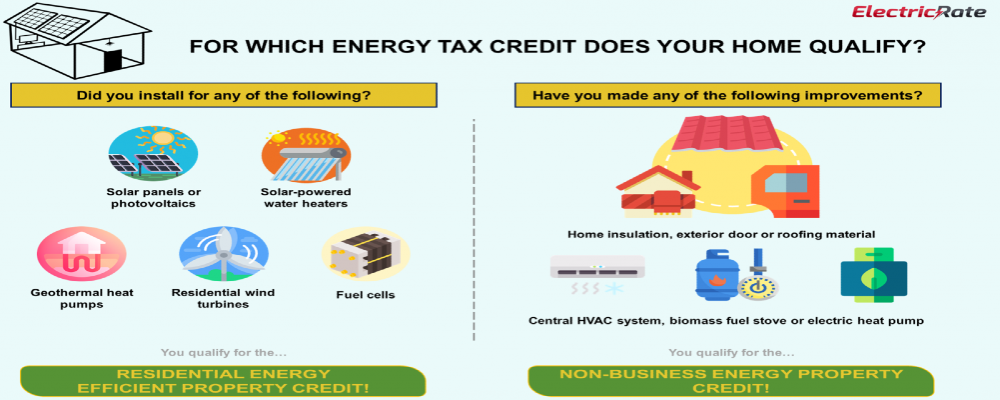

2023 Energy Efficient Home Improvement Credit and the Residential Clean Energy Credit

In a context of rapid growth in environmental awareness and sustainable living, homeowners and renters alike have the opportunity to make a positive impact while reaping financial benefits through energy-efficient home improvements. The U.S. government provides tax credits for qualified improvements to encourage individuals to invest in environmentally friendly upgrades. In this blog post, we’ll explore the details of the Energy Efficient Home Improvement Credit and the Residential Clean Energy Credit, providing a roadmap for those looking to improve their living spaces while contributing to a green future.

Energy Efficient Home Improvement Credit

Starting January 1st, 2023, homeowners can benefit from tax credits equal to 30% of certain qualified expenses, which cover a range of improvements. These include energy efficiency enhancements made during the year, expenses related to residential energy property, and the cost of home energy audits. It’s important to note that there are specific limits on the annual credit and on the credit amount for different types of qualified expenses. To be eligible for these credits, the qualifying property must be placed in service between January 1, 2023, and January 1, 2033. Each year, you can claim a credit of up to $1,200 for energy property costs and specific energy-efficient home improvements. There are limits for doors ($250 per door, $500 total), windows ($600), and home energy audits ($150). Additionally, you can claim up to $2,000 per year for qualified heat pumps, biomass stoves, or biomass boilers.

It’s crucial to understand that there is no lifetime dollar limit on these credits. This means that you can claim the maximum annual credit every year that you make eligible improvements until the year 2033. However, it’s essential to keep in mind that the credit is not refundable. You can receive a credit of up to the amount of taxes you owe, but any excess credit cannot be applied to future tax years. In simpler terms, these tax credits provide a financial incentive for homeowners to make energy-efficient improvements to their homes. The credits are applicable each year, allowing individuals to recoup a percentage of their expenses on qualified upgrades. However, it’s important to remember that the credits are non-refundable, meaning you can claim them up to the amount of taxes you owe, but any extra credit cannot be carried over to future tax years.

To claim the credit, the home must be located at United States, anything you spent on has to be your existing home, not a new home. All credits are aimed to your primary residence, primary residence is the place you lived the majority of the year, if you own a home but you don’t live there, you can’t claim any tax credits. If you use your primary residence for business purpose, then situation is varied. You can get full credit if business up to 20%; if more than 20%, credit based on share of expenses allocable to non-business use.

Qualified Expenses and Credit Amounts

What is the qualified expense? Any qualified home improvements expense must be new systems and materials, not used. Life span must last at least 5 years.

Building Envelope Components:

Must have an expected life span of 5 years.

- Exterior doors that meet applicable Energy Star requirements. Credit is limited to $250 per door and $500 total.

- Exterior windows and skylights that meet Energy Star Most Efficient certification requirements. Credit is limited to $600 total.

- Insulation and air sealing materials or systems that meet International Energy Conservation Code (IECC) standards in effect at the start of the year 2 years before installation. For example, materials or systems installed in 2025 must meet the IECC standard in effect on Jan. 1, 2023. These items don’t have a specific credit limit, other than the maximum credit limit of $1,200.

- Labor cost for installing don’t qualify the credits.

Home Energy Audits

A home energy audit for your main home may qualify for a tax credit of up to $150.

- Include a written report and inspection that identifies the most significant and cost-effective energy efficiency improvements with respect to the home, including an estimate of the energy and cost savings with respect to such improvement, and

- Be conducted and prepared by a home energy auditor.

Residential Energy Property

Residential energy property that meets the Consortium for Energy Efficiency (CEE) highest efficiency tier, not including any advanced tier, in effect at the beginning of the year when the property is installed qualifies for a credit up to $600 per item. Costs may include labor for installation.

- Central air conditioners

- Natural gas, propane, or oil water heaters

- Natural gas, propane, or oil furnaces and hot water boilers

- Costs of electrical components needed to support residential energy property, including panelboards, sub-panelboards, branch circuits, and feeders, also qualify for the credit if they meet the National Electric Code and have a capacity of 200 amps or more. There is a limit of $600 per item.

Heat Pumps and Biomass Stoves and Boilers

Heat pumps and biomass stoves and boilers with a thermal efficiency rating of at least 75% qualify for a credit up to $2,000 per year. Costs may include labor for installation.

- Electric or natural gas heat pumps

- Electric or natural gas heat pump water heaters

- Biomass stoves and boilers

To claim this tax credit, file the Form 5695, Residential energy Credits Part II, you must claim the tax credit for the tax year when the property is installed to your home, not just purchased.

Residential Clean Energy Credit

The Residential Clean Energy Credit offers a 30% incentive on the costs of new, qualified clean energy property for your home. This credit is applicable to installations made anytime from 2022 through 2032. However, it’s important to note that the credit percentage gradually decreases to 26% for property placed in service in 2033 and further down to 22% for property placed in service in 2034. To qualify for this credit, you need to have made energy-saving improvements to your home located in the United States. Unlike a refundable credit, the Residential Clean Energy Credit is nonrefundable, meaning the credit amount you receive cannot exceed the amount you owe in taxes. However, any excess unused credit can be carried forward and applied to reduce the tax you owe in future years.

There’s no annual or lifetime dollar limit for this credit, except for specific credit limits related to fuel cell property. This means you can claim the annual credit each year you install eligible property until the credit starts to phase out in 2033. It’s essential to keep in mind that interest paid, including loan origination fees, should not be included in the calculations for this credit. In summary, the Residential Clean Energy Credit provides a significant incentive for homeowners making environmentally friendly upgrades to their homes, allowing them to receive a credit on their taxes for eligible installations until the credit begins to phase out in 2033. You may claim the residential clean energy credit for improvements to your main home or primary residential, whether you own the home or rent it.

Your main home has to be the place where you live at most of the year. The credits apply to either new or existing home located in the United States, you can’t claim it if you are the landlord or owner of the home but you don’t live there. You may be able to claim a credit for certain improvements made to a second home located in the United States that you live in part-time and don’t rent to others. You can’t claim a credit for fuel cell property for a second home or for a home that is not located in the United States. If you use your primary residence for business purpose, then situation is varied. You can get full credit if business up to 20%; if more than 20%, credit based on share of expenses allocable to non-business use.

Qualified Expenses

Understanding qualified expenses for the Residential Clean Energy Credit is crucial for homeowners seeking to benefit from this incentive. Similar to the Energy Efficient Home Improvement Credit, it’s essential to note that all clean energy property must be brand new, not previously owned or used. Qualified expenses encompass various elements, including labor costs for the onsite preparation, assembly, or initial installation of the property. Additionally, expenses related to piping or wiring to connect the property to your home are considered eligible. However, it’s important to be mindful of exclusions. Traditional building components that primarily serve a roofing or structural function generally do not qualify for the credit. Examples of such components include roof trusses and traditional shingles that support solar panels. On the flip side, items like solar roofing tiles and solar shingles are considered qualified expenses because they actively generate clean energy. In summary, when contemplating qualified expenses for the Residential Clean Energy Credit, focus on new, energy-producing components, and be aware of the distinction between traditional building elements and those designed specifically to generate clean energy. This clarity ensures that homeowners can make informed decisions when seeking to leverage the benefits of this environmentally conscious incentive.

- Solar electric panels

- Solar water heaters

- Wind turbines

- Geothermal heat pumps

- Fuel cells

- Battery storage technology (beginning in 2023)

Qualified Clean Energy Property

-

- Solar water heaters must be certified by the Solar Rating Certification Corporation, or a comparable entity endorsed by your state.

- Geothermal heat pumps must meet Energy Star requirements in effect at the time of purchase.

- Battery storage technology must have a capacity of at least 3 kilowatt hours.

To claim this tax credit, file the Form 5695, Residential energy Credits, you must claim the tax credit for the tax year when the property is installed to your home, not just purchased.

In conclusion, the Energy Efficient Home Improvement Credit and Residential Clean Energy Credit offer homeowners and renters a compelling opportunity to contribute to environmental sustainability while reaping financial benefits. By incentivizing energy-efficient upgrades, the U.S. government aims to foster a greener future. The detailed breakdown of qualified expenses, eligibility criteria, and claiming processes provided in this blog serves as a valuable guide for individuals navigating the realm of eco-friendly home improvements. As we embark on a path towards responsible living, these tax credits become powerful tools, encouraging us to make informed choices that not only enhance the efficiency and comfort of our homes but also align with the broader goal of creating a more sustainable and resilient world. As you embark on your journey to improve your living space, consider the lasting impact these credits can have, both on your personal finances and our collective environmental well-being.

Please let us know if you have questions concerning nonbusiness energy credits or any other tax compliance or planning issues, we can be reached at (480) 980-3977!

- Published in Newsletters

Press Release

FOR IMMEDIATE RELEASE

Pinnacle Business Solutions LLP

19332 N. 100th Way

Scottsdale, Arizona 85255

September 6, 2023

Contact:

Paul J. Beckert MBA, CPA

President, Pinnacle Business Solutions

Email: paul@pinnacle-business.com

Phone: 480-980-3977

Pinnacle Business Solutions LLP Welcomes Tori J. Schott as Experienced Staff Accountant

Scottsdale, Arizona—Pinnacle Business Solutions LLP, a leading name in the Certified Public Accounting industry, is thrilled to announce the addition of Tori J. Schott to our growing team as an Experienced Staff Accountant. With over 2 and a half years of experience as an intern for Pinnacle Business Solutions LLP, Tori has demonstrated her expertise in providing financial, accounting, and tax services to a broad range of clients.

Ms. Schott graduated Magna Cum Laude from Arizona State University in May of 2023 with a Bachelor of Science in Accountancy, a Bachelor of Science in Management, and a dual minor in both Design and Real Estate. Her academic achievements and dedication to her studies exemplify her commitment to excellence.

In addition to her academic accomplishments, Ms. Schott is currently working toward becoming a Certified Public Accountant, further demonstrating her commitment to professional growth and ensuring she can provide top-tier services to our clients.

“We are excited to welcome Tori J. Schott to the Pinnacle Business Solutions LLP family,” said Paul J. Beckert MBA, CPA, President of Pinnacle Business Solutions. “Her extensive experience as an intern with our firm, her exceptional academic achievements, and her dedication to becoming a CPA make her a valuable asset to our team. We look forward to her continued contributions as we strive to provide the best financial services in the Certified Public Accounting industry.”

Tori J. Schott expressed her enthusiasm for joining Pinnacle Business Solutions LLP, saying, “I am thrilled to be joining the Pinnacle Business Solutions LLP team in this new role. My experiences as an intern with the company have prepared me well, and I am eager to continue providing excellent financial, accounting, and tax services to our clients while helping out my fellow Pinnacle team members.”

As an Experienced Staff Accountant, Tori J. Schott will leverage her experience and academic background to deliver outstanding results to our clients and support her fellow Pinnacle team members in their collective mission to provide exceptional service.

Please join us in extending a warm welcome to Tori J. Schott. We are confident that she will play an essential role in our continued growth and success.

For more information about Pinnacle Business Solutions LLP, please visit our website at www.pinnacle-business.com.

- Published in Newsletters